[Update 28 Jan 2009] There is an updated prediction at this post.

It is well known that technology prices fall quickly. Unless latest and greatest is vital to someone’s needs, it’s almost always advisable to wait for prices to fall. Recently, with the upgrade of laptop memory to a 204-pin 1.1 GHz DDR3 specification, prices are very high for 1×4 GB SODIMMs. Two of these will allow for 8 GB of memory in many modern laptops. I need at least 6 GB for comfortable overhead running simulations and data analysis. So, in the spirit of trying to predict when I can afford this upgrade, I’ve been compiling memory pricing data from Other World Computing for several weeks to see if there is a trend to the falling prices. My threshold is approximately $200, which is still a lot of money but, in the words of Don from Keeping the Faith, “it’s worth it.”

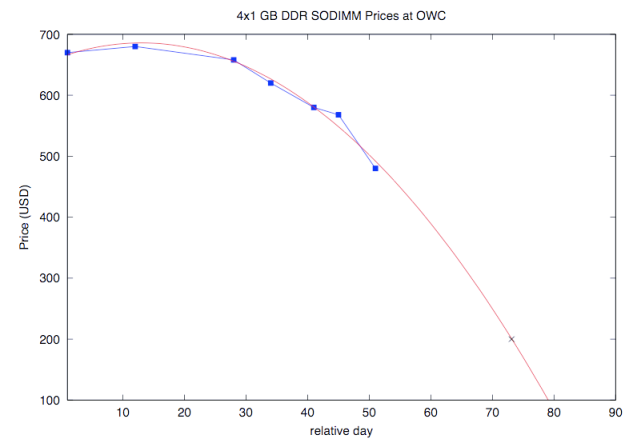

I’ve collected 7 prices (blue dots) over approximately 50 days (prices are updated about this frequently). Using this data, it looked like there was a slight increase (though with limited data), followed by a sharp decline in price over the last several weeks, which was expected. This looked vaguely quadratic, so using a least squares method and GNU Octave, I calculated a quadratic polynominal fit to this curve, which is shown in red. By extrapolating this curve until it crossed my threshold of $200, I see that occurs at approximately 73 days.

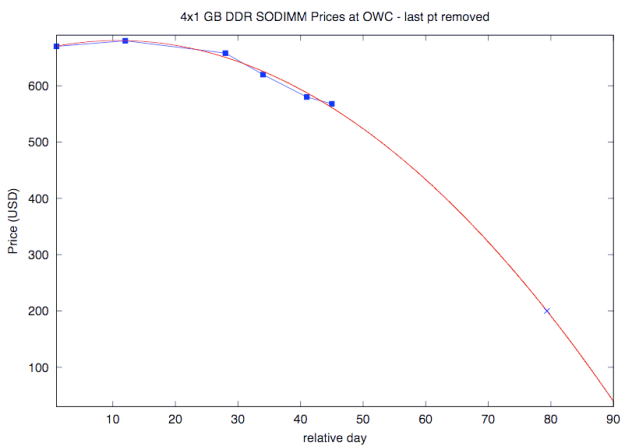

I also noticed that the price after 45 days ($567.99) dropped considerably in just 6 days ($479.99), so I recalculated the polynomial fit to account for all data up until this last change, and here’s how it changes the prediction.

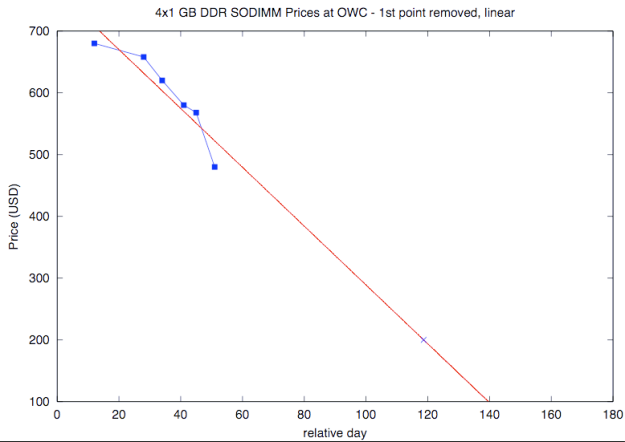

As you can see here, the prediction line (red) intersects $200 in 80 days after the start of this. Not terribly different from the first prediction. However, once we get away from the quadratic fit, things start to look a little more grim. If we take away that first point and look at this data as a linear trend, we see the following:

This is not as positive a sign. That prediction says that, from the start of my data collection, I would expect it to take a full 120 days (approximately 4 months) for the prices to reach my acceptable threshold. Other linear trends, that don’t include the most recent, most drastic drop in price, are even more grim, suggesting approximately 150 days, or 5 months from the beginning of this collection, before the price reaches $200.

Well, as it happens, we are already in day 51 of this figure. So, assuming that the most recent drop in price is part of the ongoing quadratic trend, this would suggest that I only have 22 days (less than 1 month!) of waiting for the price to go down to my threshold of $200. If, however, the linear models are more accurate, I could be 2 or 3 months away from salvation from page out hell.